Simplifying the Market

https://www.simplifyingthemarket.com/en/?a=1000030414-a6ba857b88e5d6a6279c5625493582c0

Even though there are more homes available for sale than there were at this time last year, there are still more buyers than there are houses to choose from.

Even though there are more homes available for sale than there were at this time last year, there are still more buyers than there are houses to choose from. So, know that if you™ve got moving on your mind, your house can really stand out.

There are several key reasons why there aren't enough homes to go around and understanding them will help you see why the market is working in your favor if you're ready to make a move.

What's Causing the Shortage?

1. Underproduction of Homes: For years, the industry hasn't built enough homes to keep up with demand. As Zillow explains:

In 2022, 1.4 million homes were built at the time, the best year for home construction since the early stages of the Great Recession. However, the number of U.S. families increased by 1.8 million that year, meaning the country did not even build enough to make a place for the new families, let alone begin chipping away at the deficit that has hampered housing affordability for more than a decade.

2. Rising Costs: Building materials, labor shortages, and supply chain disruptions caused by the pandemic have all made it harder and more expensive to build homes. This can either limit or stop new home construction in some areas.

3. Regional Imbalances: Some markets are more affected by the shortage of homes than others. Popular and more desirable areas have more people moving in faster than new homes can be built. The number of new building permits issued doesn't always keep pace with job growth in these regions, and that leads to even tighter markets and higher prices.

How Big Is the Problem?

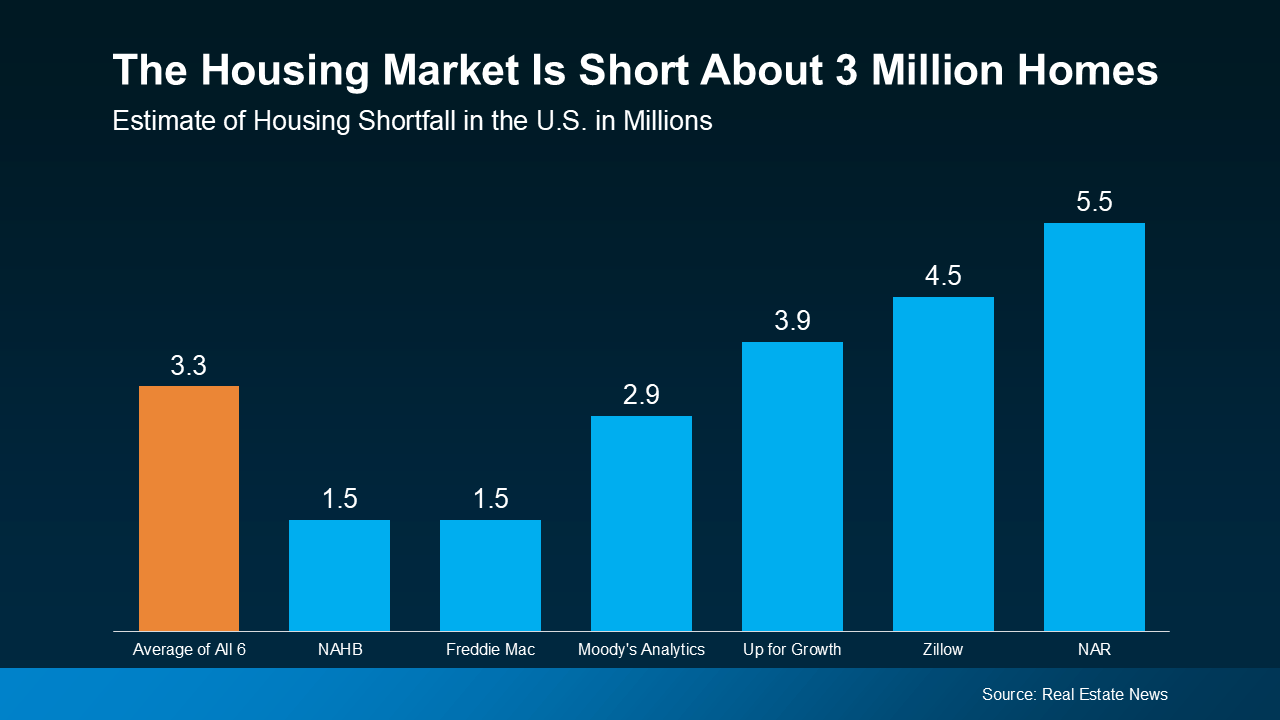

According to estimates from Real Estate News, the U.S. is facing a housing shortfall of roughly 3.3 million homes, based on an average of several expert insights (see graph below):

This shows there's a significant number of homes that need to be built just to meet current demand from buyers. But what about future demand?

This shows there's a significant number of homes that need to be built just to meet current demand from buyers. But what about future demand?

According to John Burns Research and Consulting (JBREC), over the next 10 years, the U.S. will need about 18 million new homes to meet projected demand, including homes for new households, second homes, and replacements for aging or unusable homes.

So, even though more homes are on the market compared to last year, there still aren't enough of them to go around. This is where you can really win if you're ready to sell your house.

What You Need To Remember

If you're thinking about selling, the shortage of homes for sale means your house is likely to get some serious attention from buyers. It'll take years to climb out of this inventory deficit, and the market is still very tight. So, when buyers are competing for relatively few homes like they are right now, that creates more interest in the houses that are on the market, putting upward pressure on prices and ultimately working in your favor.

And since every market is different, it's important to work with a real estate agent who understands local trends. They can help you price your house right and create a strategy to attract the right buyers.

Bottom Line

While there are more homes for sale than there were at this time last year, there's still a shortage overall. And this puts you in the driver's seat as a seller. Reach out to a trusted real estate agent who can help you take advantage of today's market.

For Buyers Inventory Affordability Mon, 28 Oct 2024 10:30:00 +0000

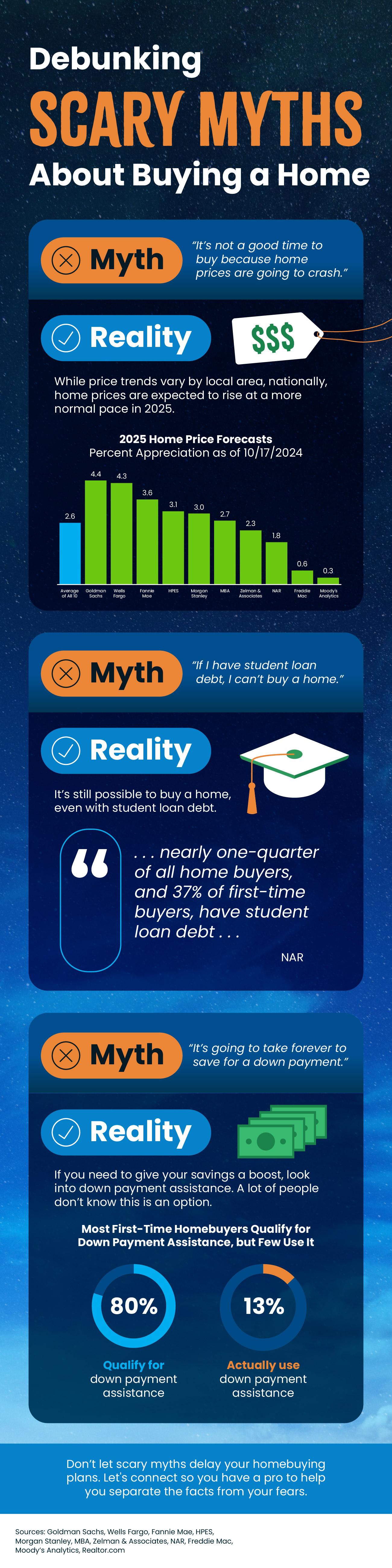

There are a number of scary myths about homebuying in today's market. Here's what you need to know.

Some Highlights

- There are a number of scary myths about homebuying in today's market. Here's what you need to know.

- Prices are not expected to crash, it is possible to buy even with student loan debt, and there are programs that can help you save for a down payment.

- Don't let scary myths delay your homebuying plans. Connect with an agent so you have a pro to help you separate the facts from your fears.

For Buyers Infographics Fri, 25 Oct 2024 10:30:00 +0000

With everything feeling more expensive these days, it's natural to worry about how rising costs might impact the housing market.

With everything feeling more expensive these days, it's natural to worry about how rising costs might impact the housing market. Many people are concerned that high prices and tighter budgets could cause more homeowners to fall behind on their mortgage payments, leading to a wave of foreclosures.

But before you start worrying about a housing market crash, here's a look at what's really happening. And the good news is: the latest foreclosure data shows there's no wave on the horizon.

How Today's Market Is Different from 2008

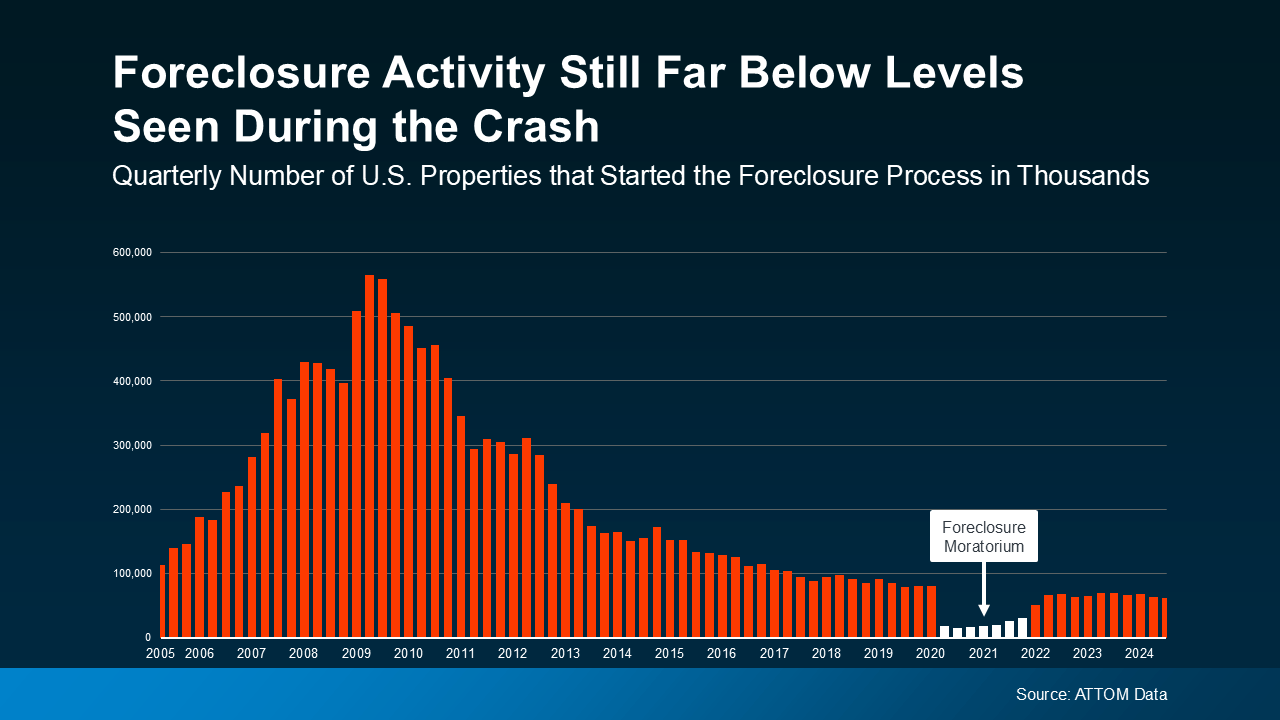

Let's ease those fears by looking at the bigger picture. The graph below uses research from ATTOM, a property data provider, to show that the number of homeowners starting the foreclosure process is nowhere near what we saw coming out of 2008. Back then, there was a big spike in how many foreclosures were happening. Today, the number is much lower “ it's even dropped some in the latest report. There's a big difference between what's happening now, and what happened when the housing market crashed (see graph below):

Just in case you're wondering why the number of foreclosure filings has ticked up slightly since 2020 and 2021, here's what you need to know. During those years, there was a moratorium (shown in white) designed to help millions of homeowners avoid foreclosure in challenging times. That's why the numbers for just a few years ago were so incredibly low. If you look further back, it's clear overall foreclosure filings are down significantly.

Just in case you're wondering why the number of foreclosure filings has ticked up slightly since 2020 and 2021, here's what you need to know. During those years, there was a moratorium (shown in white) designed to help millions of homeowners avoid foreclosure in challenging times. That's why the numbers for just a few years ago were so incredibly low. If you look further back, it's clear overall foreclosure filings are down significantly.

And if you're wondering: how are there fewer foreclosures today, even when the cost of living has gotten so pricey? Here's your answer. One of the main reasons is that homeowners today have a lot more equity built up in their homes than they did back in 2008. As an article from Bankrate explains:

In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That's not the case now. Most homeowners have a comfortable equity cushion in their homes.

This equity acts like a safety net and is allowing many homeowners to avoid going into foreclosure if they're facing financial hardships. Even if someone is struggling to make their monthly payments, they may be able to sell their home and avoid foreclosure altogether. This is a far cry from the conditions during the crash when homeowners owed more on their mortgages than their homes were worth.

What's Ahead for the Housing Market

It's true that today's higher cost of living across the board is a challenge for many people right now. But this doesn't mean we're heading for a surge in foreclosures.

The equity cushion that people have is helping to keep foreclosure filings low. Today's homeowners have more options to avoid going into foreclosure.

Bottom Line

Yes, everyday costs for gas and food have gotten more expensive”but that doesn't mean the housing market is on the brink of another foreclosure crisis. Data shows the market is far from a foreclosure wave. Homeowners today are in a much stronger financial position than they were during the 2008 crash, thanks to significant equity.

Foreclosures Economy Thu, 24 Oct 2024 10:30:00 +0000

As you're getting ready to sell your house, one of the first questions you're probably asking is, how long is this going to take?

As you're getting ready to sell your house, one of the first questions you're probably asking is, how long is this going to take? And that makes sense”you want to know what to expect.

While every market is different, understanding what's happening nationally can give you a good baseline. But for an even more detailed look at real estate conditions in your area, connect with a local real estate agent. They know your local market best and can explain what's happening near you and how it compares to national trends.

Here's a look at some of the things a great agent will walk you through during that conversation.

More Homes Are on the Market, and That's Affecting How Long They Take To Sell

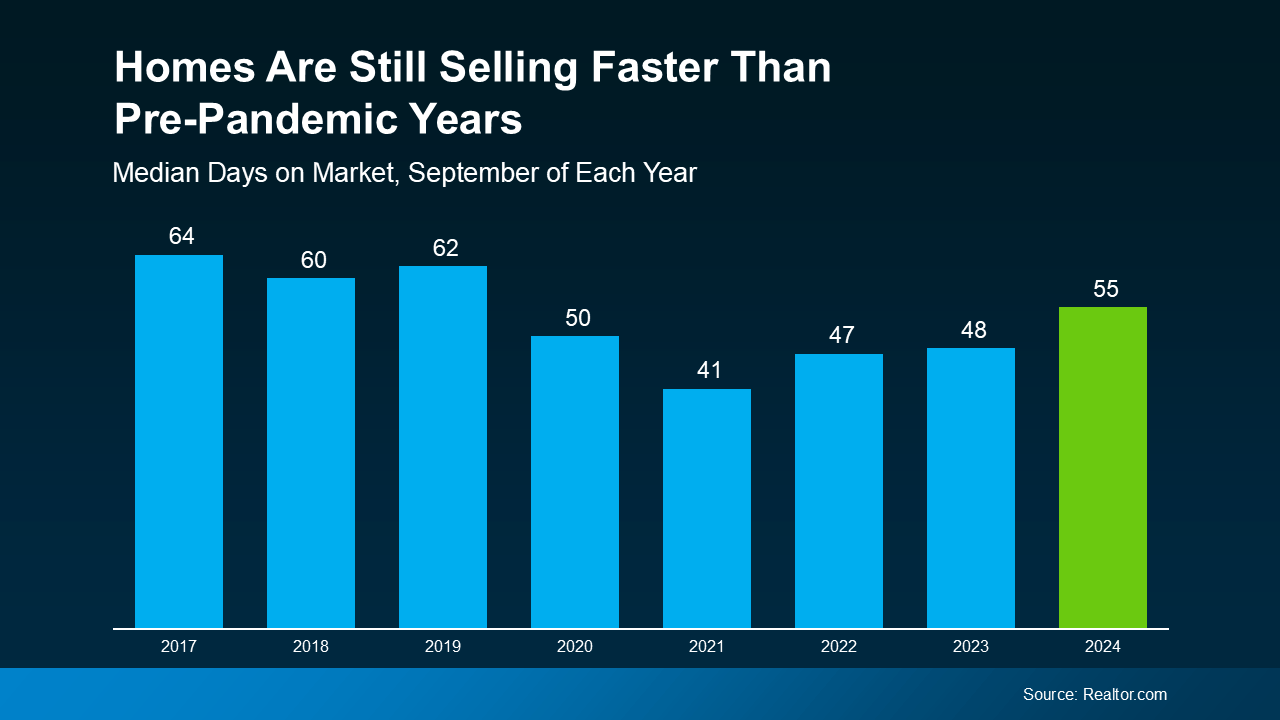

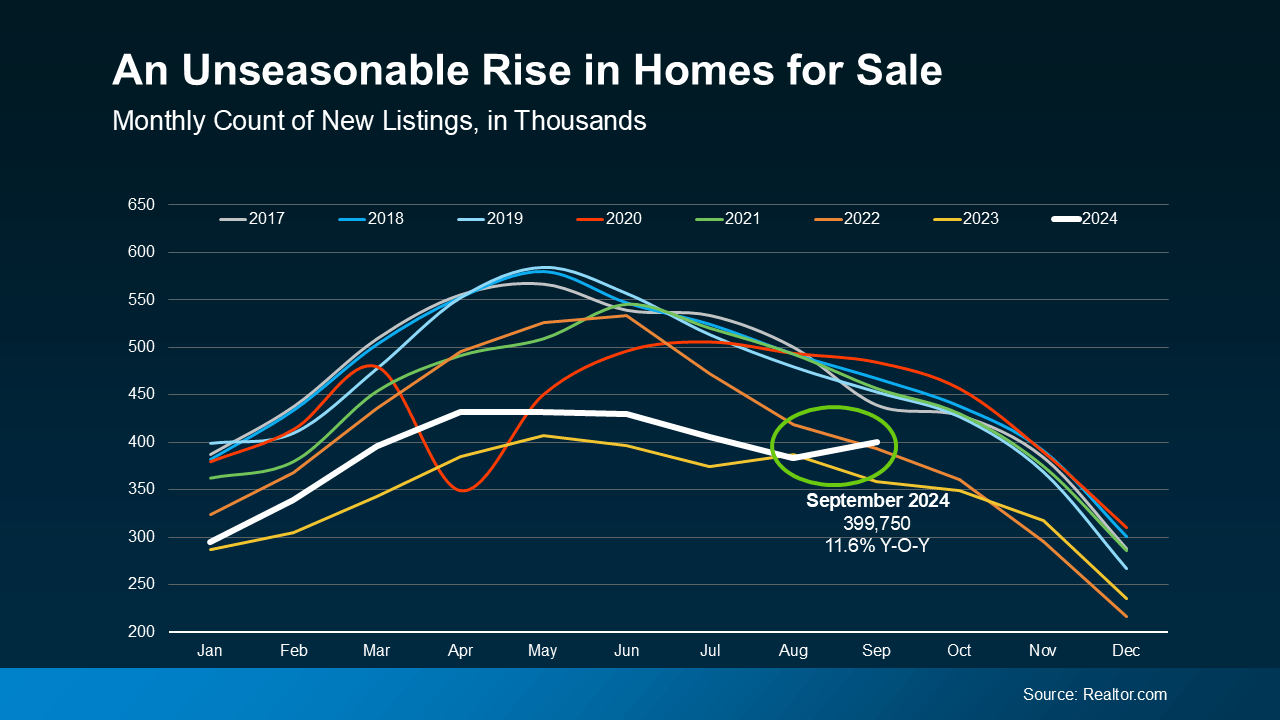

According to Realtor.com, the number of homes for sale has been going up this year. That means there are more options for buyers, which is great news for anyone looking to buy a home. But as a seller, it also means homes are staying on the market a bit longer now that buyers have more options to choose from (see graph below):

One of the big reasons homes sold so fast in recent years is because there were so few of them for sale. And now that there are more houses on the market, it makes sense that they aren't selling at quite the same pace. Right now, according to Realtor.com, it takes 55 days from the time a house is listed for it to be officially sold and closed on.

One of the big reasons homes sold so fast in recent years is because there were so few of them for sale. And now that there are more houses on the market, it makes sense that they aren't selling at quite the same pace. Right now, according to Realtor.com, it takes 55 days from the time a house is listed for it to be officially sold and closed on.

But keep this in mind. While homes might not be selling as quickly as they did last year at this time, they're still selling faster than they did in more normal years in the housing market, before the pandemic.

If you look back at 2017-2019 in the graph above, you'll see that it was typical for a house to take 60 days or more to sell. So, today's process is still faster than the norm.

That's because, even with more homes for sale, there are still more buyers than homes for sale. So, homes that show well and are priced right are selling fast. As NerdWallet explains:

Overall, though, demand still outpaces supply. This is hardly a mellow market: Good homes sell quickly . . .

Your Agent Can Help Your Home Stand Out

If you're looking for ways to make your move happen as quickly as possible, partnering with a great local agent is the key. Your real estate agent will help you with everything from setting the right price to staging your home so it looks its best. They'll even create a marketing plan that grabs buyers' attention and will give you key insights about what's happening in your specific area, so you can plan accordingly and make the process go as smoothly as possible.

So, while homes might be on the market a little longer than before, they're still selling faster than the norm. If you have the right agent and the right strategy in place, your house may even sell faster than you'd expect.

Bottom Line

If you're planning to sell your house, knowing how long it might take is a big part of planning your next steps. By working with a local expert, you'll be able to price, market, and sell your home with confidence.

]]> For Sellers Agent Value Wed, 23 Oct 2024 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2024/10/22/planning-to-sell-your-house-in-2025-start-prepping-now?a=1000030414-a6ba857b88e5d6a6279c5625493582c0

If your goal is to sell your house in 2025, now's the time to start prepping.

If your goal is to sell your house in 2025, now's the time to start prepping. Even though it might seem like there's plenty of time between now and the new year, you should get a head start on any updates or repairs you want to make now. As Danielle Hale, Chief Economist at Realtor.com, says:

. . . now is the time to start thinking about what you need for your next home and then taking those steps to prepare to list . . . We have survey data that says 47 percent of sellers are taking longer than a month to get their home ready to sell, so getting them to start that process early can mean more flexibility.

By starting your prep work early, you'll give yourself plenty of time to get your house market-ready by the end of the year. But be sure to partner with a great agent before you get started, so you have expert insight into what repairs are worth it based on your local market.

Why Starting Early Is Key

To get the best price and sell quickly, it's important that your home looks its best. And that means it's up to you to make the necessary repairs, declutter, and even consider updates that could add value as part of getting your house ready to list.

By starting now, you can tackle things one task at a time. Whether it's fixing that leaky faucet, refreshing your landscaping, or painting a room, getting an early start gives you the flexibility to do the job right and with as little stress as possible. Because, if you wait to knock items off your list later on, they could quickly stack up and get overwhelming. As Realtor.com explains:

There are some important repairs to make before selling a house, so don't be in too much of a hurry to get your home listed ¦ if you move too fast, buyers see right through the fact that you skipped important home renovations. And this . . . might end up costing you time and money.

What Should You Focus On?

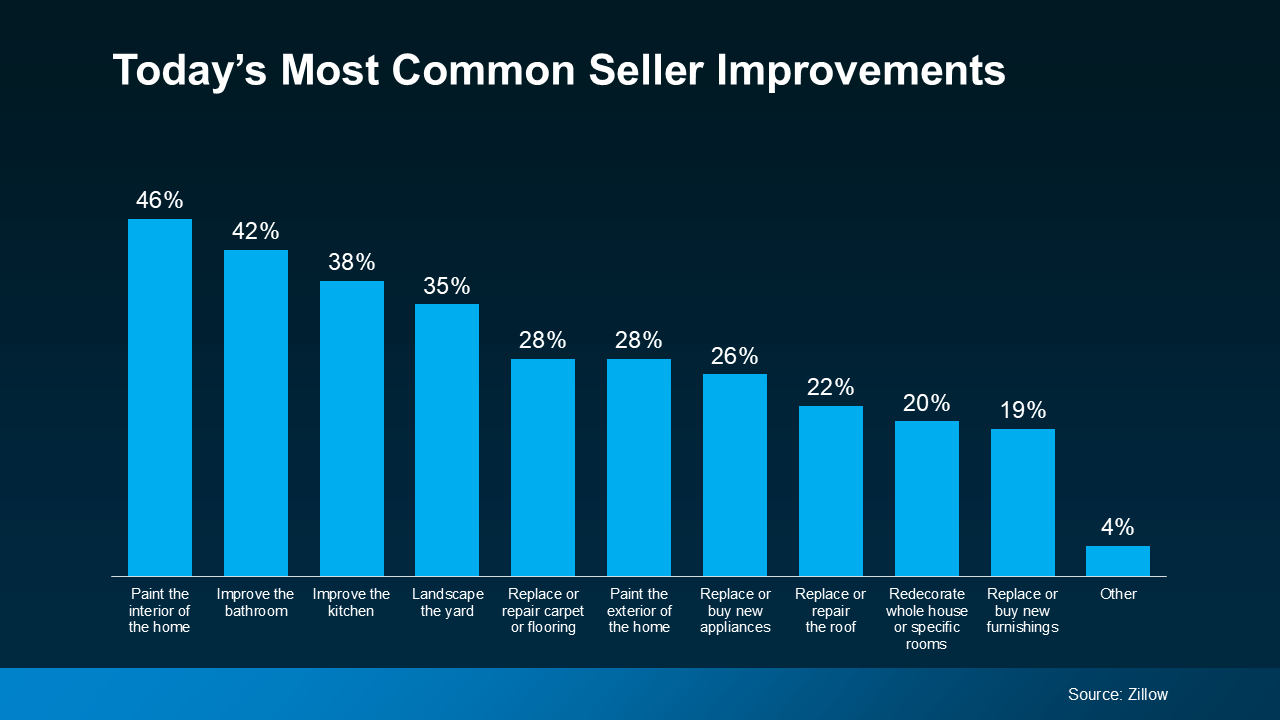

Feeling motivated to start chipping away at that to-do list, but not sure where to start? Here's a look at the most common improvements other sellers are making today (see graph below):

The Importance of Working with a Local Agent

The Importance of Working with a Local Agent

And while that data gives you a starting point, it shouldn't be seen as a comprehensive list. What buyers want in your area may be different, and only a local agent will have this in-depth understanding.

For example, if homes in your area are selling quickly with updated kitchens, your agent might suggest focusing on minor kitchen improvements rather than spending money on other areas that won't offer as much return. They'll also help you figure out if tackling larger projects, such as replacing your roof or upgrading your HVAC system, is worth it based on other recently sold homes. As Point says:

Not all renovations are created equal, and focusing on upgrades that offer the highest potential for increasing your home's value is key.

And remember, it's not just big-ticket items that can have an impact. Your agent will also speak to some of the smaller details “ like cleaning up your yard, adding fresh mulch, or painting your front door “ to make a real difference in how buyers feel about your home. This type of expert eye is crucial to help your house sell fast and for top dollar.

Bottom Line

Thinking of selling your house next year? Don't wait until the last minute to get it ready. By getting a head start now, you can ensure everything is in place by the time the new year rolls around.

Need advice on what to tackle first? Connect with a local agent.

]]> For Sellers Agent Value Tue, 22 Oct 2024 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2024/10/21/what-to-expect-from-mortgage-rates-and-home-prices-in-2025?a=1000030414-a6ba857b88e5d6a6279c5625493582c0

Curious about where the housing market is headed in 2025?

]]>

Curious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices.

Whether you're thinking of buying or selling, here's a look at what the experts are saying and how it might impact your move.

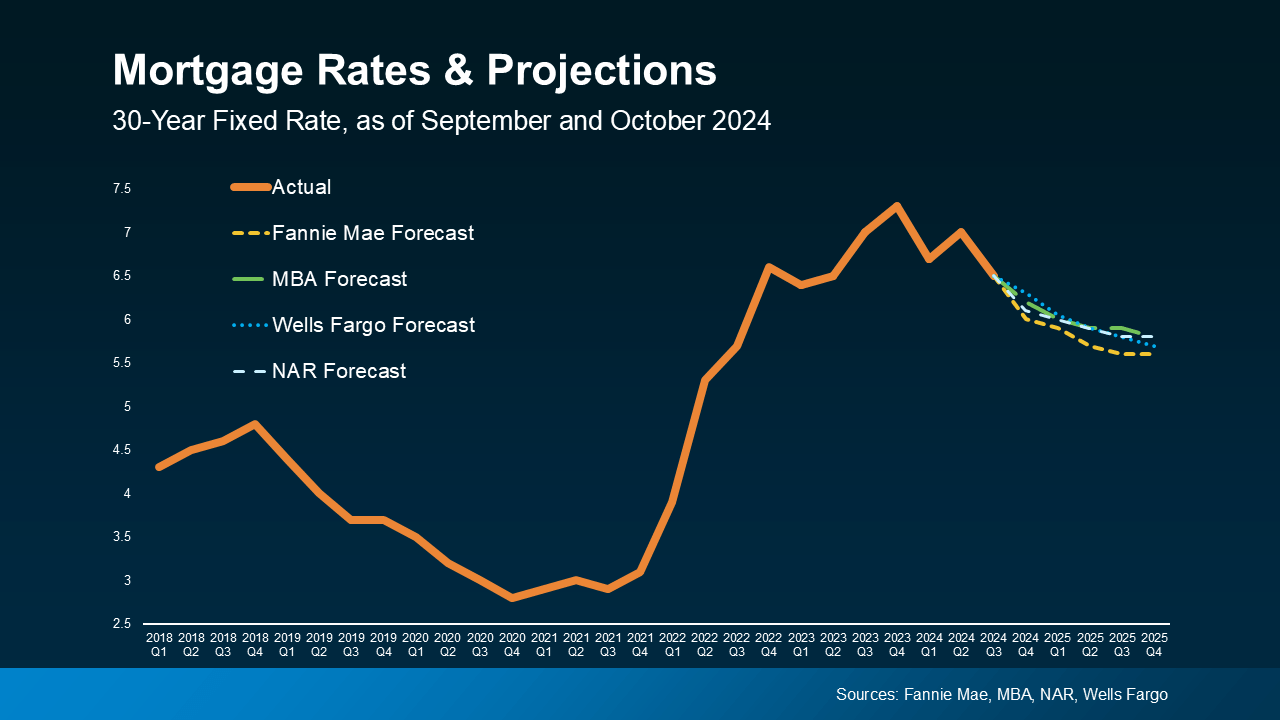

Mortgage Rates Are Forecast To Come Down

One of the biggest factors likely affecting your plans is mortgage rates, and the forecast looks positive. After rising dramatically in recent years, experts project rates will ease slightly throughout the course of 2025 (see graph below):

While that decline won't be a straight line down, the overall trend should continue over the next year. Expect a few bumps along the way, because the trajectory of rates will depend on new economic data and inflation numbers as they're released. But don't get too hung up on those blips and reactions from the market as they happen. Focus on the bigger picture.

While that decline won't be a straight line down, the overall trend should continue over the next year. Expect a few bumps along the way, because the trajectory of rates will depend on new economic data and inflation numbers as they're released. But don't get too hung up on those blips and reactions from the market as they happen. Focus on the bigger picture.

Lower mortgage rates mean improving affordability. As rates come down, your monthly mortgage payment decreases, giving you more flexibility in what you can afford if you buy a home.

This shift will likely bring more buyers and sellers back into the market, though. As Charlie Dougherty, Director and Senior Economist at Wells Fargo, explains:

Lower financing costs will likely boost demand by pulling affordability-crunched buyers off of the sidelines.

As that happens, both inventory and competition among buyers will ramp back up. The takeaway? You can get ahead of that competition now. Lean on your agent to make sure you understand how the shifts in rates are impacting demand in your area.

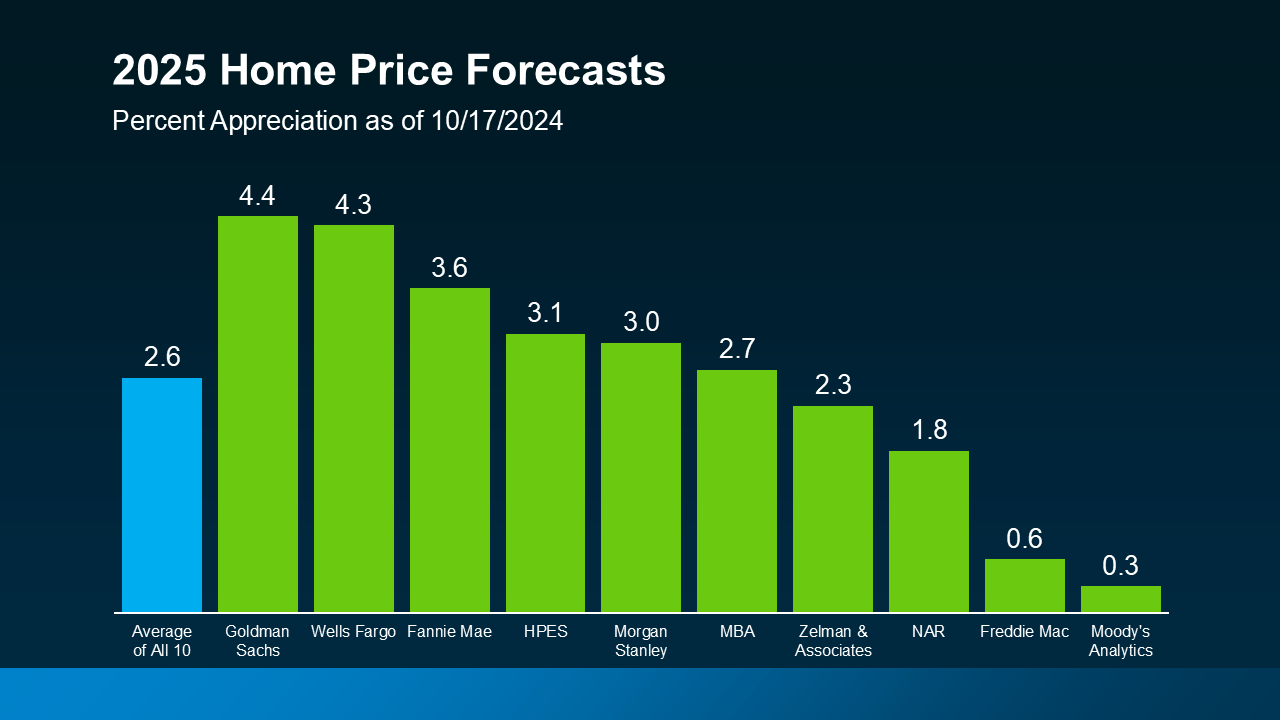

Home Price Projections Show Modest Growth

While mortgage rates are expected to come down slightly, home prices are forecast to rise”but at a much more moderate pace than the market has seen in recent years.

Experts are saying home prices will grow by an average of about 2.5% nationally in 2025 (see graph below):

This is far more manageable than the rapid price increases of previous years, which saw double-digit percentage growth in some markets.

This is far more manageable than the rapid price increases of previous years, which saw double-digit percentage growth in some markets.

What's behind this ongoing increase in prices? Again, it has to do with demand. As more buyers return to the market, demand will rise “ but so will supply as sellers feel less rate-locked.

More buyers in markets with inventory that's still below the norm will put upward pressure on prices. But with more homes likely to be listed, supply will help keep price growth in check. This means that while prices will rise, they'll do so at a healthier, more sustainable pace.

Of course, these national trends may not reflect exactly what's happening in your local market. Some areas might see faster price growth, while others could see slower gains. As Lance Lambert, Co-Founder of ResiClub, says:

Even if the average national home price forecast for 2025 is correct, it's possible that some regional housing markets could see mild home price declines, while some markets could still see elevated appreciation. That has been, after all, the case this year.

Even the few markets that may see flat or slightly lower prices in 2025 have had so much appreciation in recent years “ it may not have a big impact. That's why it's important to work with a local real estate expert who can give you a clear picture of what's happening where you're looking to buy or sell.

Bottom Line

With mortgage rates expected to ease and home prices projected to rise at a more moderate pace, 2025 is shaping up to be a more promising year for both buyers and sellers.

If you have any questions about how these trends might impact your plans, connect with a local agent. That way you've got someone to help you navigate the market and make the most of the opportunities ahead.

]]> For Buyers For Sellers Home Prices Mortgage Rates Affordability Mon, 21 Oct 2024 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2024/10/18/why-buying-now-is-worth-it-infographic?a=1000030414-a6ba857b88e5d6a6279c5625493582c0

You may be torn between buying a home now or waiting. But don't forget to factor in the equity you'll gain as prices rise.

]]>

Some Highlights

- You may be torn between buying a home now or waiting. But don't forget to factor in the equity you'll gain as prices rise.

- Experts forecast prices will climb over the next 5 years “ and based on those forecasts, you could gain about $90k in equity in that time.

- So, you could wait, but you'll miss out on a lot of equity if you do. If you're ready and able to buy, let's connect so you can start growing your wealth now.

]]> For Buyers Infographics Buying Tips Equity Forecasts Fri, 18 Oct 2024 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2024/10/17/why-did-more-people-decide-to-sell-their-homes-recently?a=1000030414-a6ba857b88e5d6a6279c5625493582c0

Homeowners typically slow down their moving plans as the summer months wrap up, and as a result, fewer homes are listed for sale in the fall.

]]>

Homeowners typically slow down their moving plans as the summer months wrap up, and as a result, fewer homes are listed for sale in the fall. It's a predictable, seasonal trend in real estate. But this year, mortgage rates came down at the same time the number of homes on the market usually starts to decline. So, what happened? More homeowners decided to sell, so more homes came to the market.

The most recent data from Realtor.com reveals that in September, the number of homes put up for sale increased by 11.6% compared to this time last year.

As the green circle in the graph below shows, the typical September decline in homes coming to the market didn't happen “ that number actually went up (see graph below):

Ralph McLaughlin, Senior Economist at Realtor.com, explains why there was an unseasonable rise:

Ralph McLaughlin, Senior Economist at Realtor.com, explains why there was an unseasonable rise:

This sharp increase is largely due to the decline in mortgage rates in mid-August, enticing homeowners to sell.

So, as rates came down at the end of the summer, more people jumped into the market and decided to make their move.

What Does This Mean If You're Looking To Buy a Home?

It means more fresh options to choose from than you've had in a while “ not the ones that have been sitting around, unsold.

But keep in mind, mortgage rates have been volatile lately, ticking up slightly in recent weeks, which could limit the number of people who feel comfortable with the idea of selling in the months ahead. And in this market, it's mortgage rates that are largely driving homeowner decisions.

Why Buy Now, Rather Than Wait?

Whether you're looking for a starter home, an upgrade, or hoping to downsize, you have more homes to choose from right now. And if you can find what you're looking for, know that these new, fresh options won't be on the market forever. So, staying on top of what's available in your local area with a trusted agent is key.

And remember, one month doesn't make a trend. So, what does that mean going forward? Whether more homeowners than normal continue to put their houses on the market will largely depend on what happens with mortgage rates and the economic factors that impact them, like inflation, employment, and the reactions by the Federal Reserve.

With that in mind, now might be your moment, while more homes are available “ if you're ready, willing, and able to buy this fall.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

The rise in inventory “ and, more technically, the accompanying months' supply “ implies home buyers are in a much-improved position to find the right home and at more favorable prices.

Bottom Line

As rates came down at the end of the summer, sellers started to trickle back into the market, which means buyers have more choices right now. And working with a trusted local real estate agent is the best way to take advantage of your new options before they're all scooped up.

]]> For Buyers Mortgage Rates Buying Tips Thu, 17 Oct 2024 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2024/10/16/the-benefits-of-using-your-equity-to-make-a-bigger-down-payment?a=1000030414-a6ba857b88e5d6a6279c5625493582c0

Did you know? Homeowners are often able to put more money down when they buy their next home.

]]>

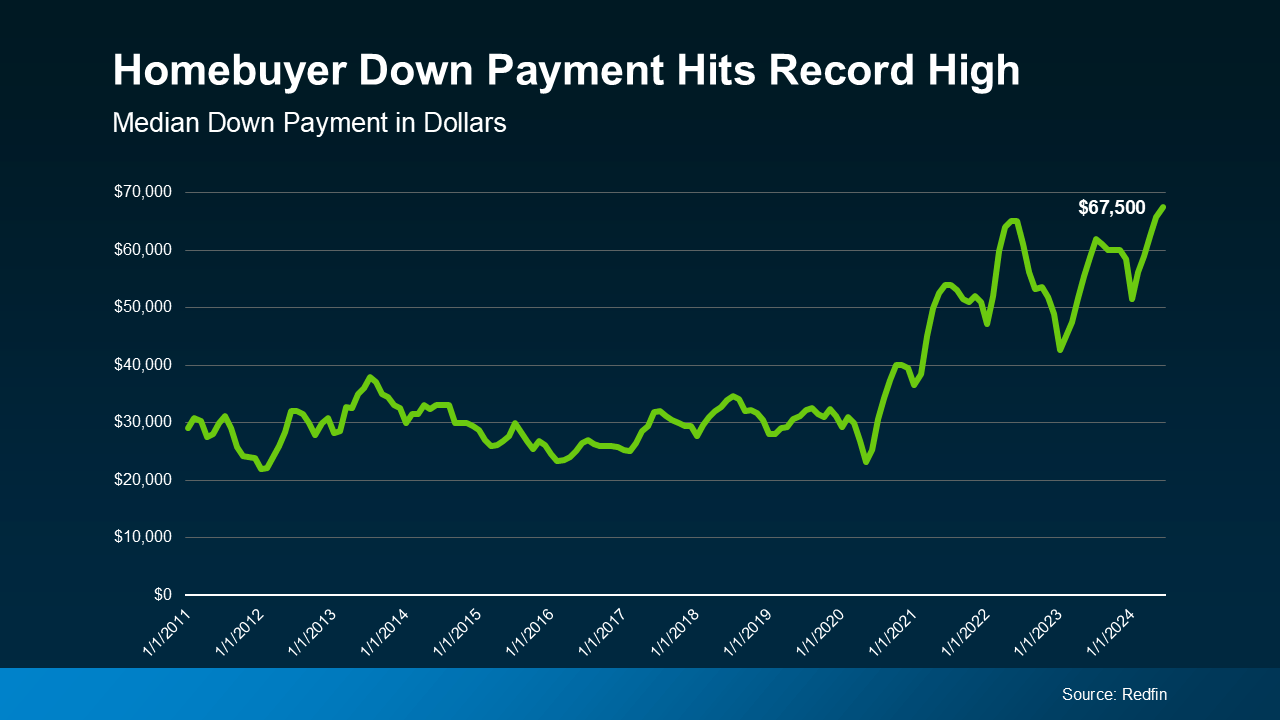

Did you know? Homeowners are often able to put more money down when they buy their next home. That's because, once they sell, they can use the equity they have in their current house toward their next down payment. And it's why as home equity reaches a new height, the median down payment has too.

According to the latest data from Redfin, the typical down payment for U.S. homebuyers is $67,500”that's nearly 15% more than last year, and the highest on record (see graph below):

Here's why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a larger down payment on your new home. That's a major opportunity, especially if you've had concerns about affordability.

Here's why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a larger down payment on your new home. That's a major opportunity, especially if you've had concerns about affordability.

Now, it's important to remember you don't have to make a big down payment to buy your next home”there are loan programs that let you put as little as 3%, or even 0% down. But there's a reason so many current homeowners are opting to put more money down. That's because it comes with some serious perks.

Why a Bigger Down Payment Can Be a Game Changer

1. You'll Borrow Less and Save More in the Long Run

When you use your equity to make a bigger down payment on your next home, you won't have to borrow as much. And the less you borrow, the less you'll pay in interest over the life of your loan. That's money saved in your pocket for years to come.

2. You Could Get a Lower Mortgage Rate

Providing a larger down payment shows your lender you're more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage rate they'll likely be willing to give you. And that amplifies your savings.

3. Your Monthly Payments Could Be Lower

A bigger down payment doesn't just help you reduce how much you have to borrow”it also means your monthly mortgage payment may be smaller. That can make your next home more affordable and give you a bit more breathing room in your budget.

4. You Can Skip Private Mortgage Insurance (PMI)

If you can put down 20% or more, you can avoid Private Mortgage Insurance (PMI), which is an added cost many buyers have to pay if their down payment isn't as large. Freddie Mac explains it like this:

For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same thing as homeowner's insurance. It's a monthly fee, rolled into your mortgage payment, that's required if you make a down payment less than 20%.

Avoiding PMI means you'll have one less expense to worry about each month, which is a nice bonus.

Bottom Line

Down payments are at a record high, largely because recent equity gains are putting homeowners in a position to put more money down.

If you're thinking about selling your current house and moving, reach out to a trusted real estate agent. They'll help you figure out how much home equity you have right now, and how it can boost your buying power in today's market.

]]> For Buyers Home Prices Mortgage Rates Affordability Equity Wed, 16 Oct 2024 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2024/10/15/why-an-agent-is-essential-when-buying-a-newly-built-home?a=1000030414-a6ba857b88e5d6a6279c5625493582c0

For some buyers, there's a misconception that newly built homes aren't made to last or fall short of the quality you can find in older homes.

]]>

For some buyers, there's a misconception that newly built homes aren't made to last or fall short of the quality you can find in older homes. Unfortunately, this is turning some buyers away from what may be one of their best options in today's housing market. As Builder Online says:

As resale inventory remains limited and the price spread between new and resale homes narrows, new homes are increasingly an attractive value proposition for buyers, with incentives such as rate buydowns a way to help address ongoing affordability challenges.

So, is there any merit to the myth? Let's break down the best way to make sure you feel good about looking into new home construction. That way, you're not missing out on such a great option today.

Choosing the Right Builder

The key to making sure you get a quality newly built home is to choose a good builder. Reputable builders adhere to strict building codes and standards, use advanced construction techniques, and often offer warranties that cover structural issues for several years. That's why the Mortgage Reports offers this advice:

When embarking on the journey of buying a new construction home, one of the most important steps is selecting the right builder. This decision can significantly impact the quality and satisfaction you derive from your new home.

And while you could dig into research about all the builders in your area, there's an easier option to get the job done: lean on a pro. When you work with a local real estate agent, they already know about the builders and the new home communities under construction in your area.

Beyond that, maybe they've even worked with other buyers who opted for a home in one of those neighborhoods. Here are just a few of the things your agent will help you with:

1. The Builder's Reputation: Your agent will help point you toward builders with strong reputations and positive reviews from previous buyers. Additionally, your agent will make sure the builder is licensed and insured. Membership in professional organizations, such as the National Association of Home Builders (NAHB), is also a good sign of a builder's commitment to industry standards.

2. Their Model Homes: Your agent will also be able to tell you if the builders have model homes you can tour. And when your agent walks through the model with you, they'll draw your attention to the little details that matter most. Things like the quality of finishes, layout, and overall feel of the home.

3. Builder Warranties: Your agent will also be able to help you navigate any builder offers or incentives. Reputable builders often provide warranties to cover major structural elements of the home for a significant period of time. This is a testament to their confidence in the quality of their construction.

4. Getting Inspections: Even with new homes, inspections are crucial. Your agent will coordinate the inspections with licensed professionals to ensure the home meets safety and quality standards before you move in.

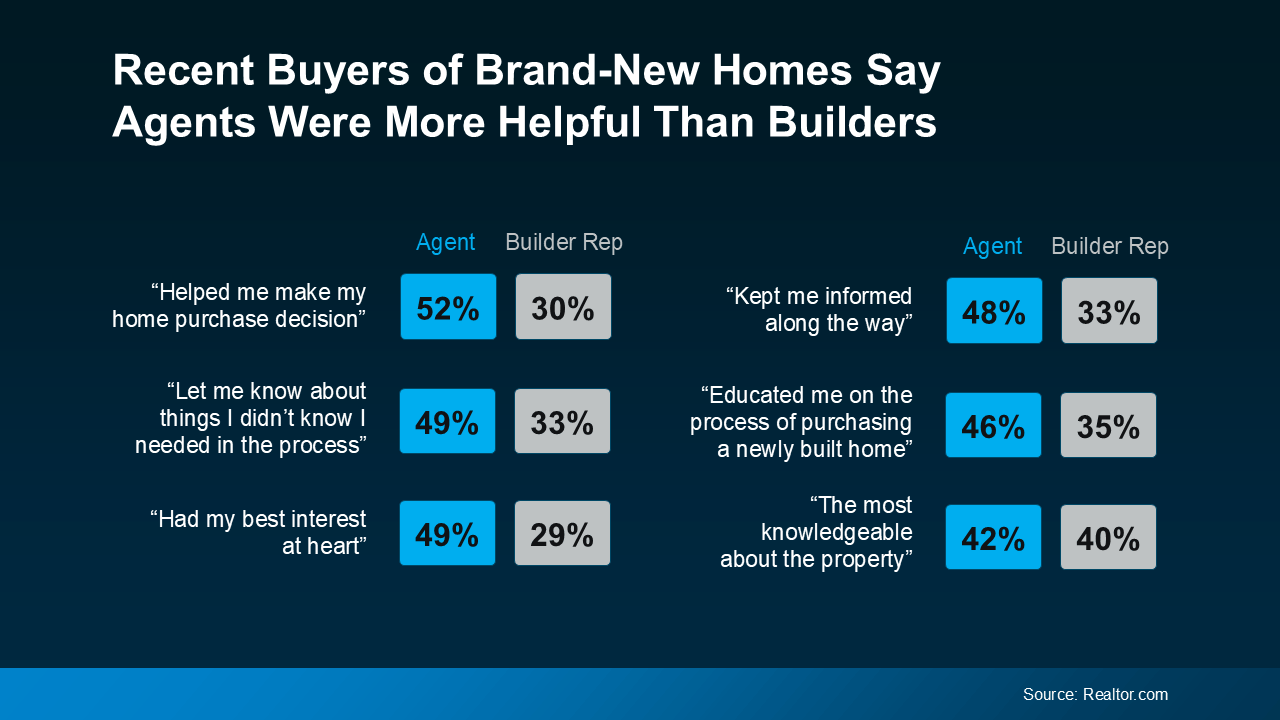

Agents Are the MVP When You're Buying a Brand-New Home

Maybe that's why data shows homebuyers unanimously scored their agents higher than their builders when looking back on their recent purchase:

So, you don't need to worry that they just don't make them like they used to. By working with a knowledgeable real estate agent to choose a reputable builder, you can feel confident when buying a newly built home today. As Realtor.com says:

So, you don't need to worry that they just don't make them like they used to. By working with a knowledgeable real estate agent to choose a reputable builder, you can feel confident when buying a newly built home today. As Realtor.com says:

If you are interested in buying a new construction . . . You need your own real estate agent from the get-go. Even if it seems like plug and play to sign up with the builder's on-site agent, you're going to want someone representing your side of the deal.

Bottom Line

If you're considering buying a brand-new home, don't let misconceptions hold you back. Work with a local real estate agent to find a home you'll love and be proud to call your own.

]]> For Buyers Agent Value Buying Tips Tue, 15 Oct 2024 10:30:00 +0000

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "